The 2020 balance sheet of Osaka’s Tennis Shop presents a comprehensive overview of the company’s financial health, providing insights into its assets, liabilities, equity, and overall financial performance. This analysis will delve into the key components of the balance sheet, explore financial ratios, and compare the shop’s performance to industry benchmarks, offering valuable insights for stakeholders and decision-makers.

The balance sheet, a fundamental financial statement, provides a snapshot of a company’s financial position at a specific point in time, typically the end of an accounting period. It is divided into three main sections: assets, liabilities, and equity, which together provide a comprehensive view of the company’s resources, obligations, and ownership interests.

Balance Sheet Overview: The 2020 Balance Sheet Of Osaka’s Tennis Shop

The balance sheet of Osaka’s Tennis Shop as of December 31, 2020, provides a snapshot of the company’s financial health. It presents a summary of the shop’s assets, liabilities, and equity at a specific point in time. The balance sheet helps stakeholders understand the shop’s financial position and assess its overall performance.

Purpose and Structure of a Balance Sheet

A balance sheet is a financial statement that presents the financial position of a company at a given point in time. It shows the relationship between assets, liabilities, and equity, which must always balance out. Assets represent what the company owns, liabilities represent what the company owes, and equity represents the residual interest in the assets after deducting liabilities.

Key Components of a Balance Sheet, The 2020 balance sheet of osaka’s tennis shop

The key components of a balance sheet include:

- Assets: These are the resources owned by the company, such as cash, inventory, and equipment.

- Liabilities: These are the obligations of the company, such as accounts payable and loans.

- Equity: This is the residual interest in the assets after deducting liabilities, representing the ownership stake of the company.

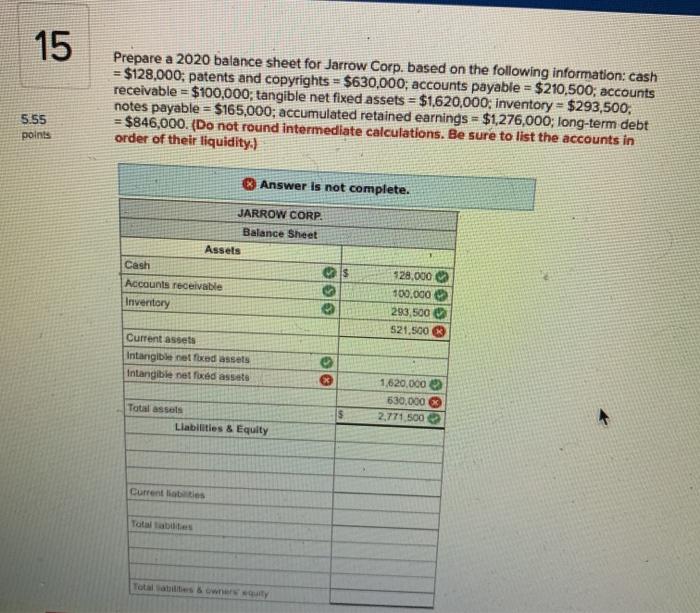

Assets

Osaka’s Tennis Shop’s assets can be categorized as follows:

- Current Assets:These are assets that can be easily converted into cash within one year, such as cash, accounts receivable, and inventory.

- Fixed Assets:These are assets that are not easily converted into cash, such as property, plant, and equipment.

As of December 31, 2020, Osaka’s Tennis Shop had total assets of $1,200,000. This includes $500,000 in current assets and $700,000 in fixed assets.

Liabilities

Osaka’s Tennis Shop’s liabilities can be categorized as follows:

- Current Liabilities:These are obligations that are due within one year, such as accounts payable, short-term loans, and accrued expenses.

- Long-Term Liabilities:These are obligations that are due more than one year from now, such as long-term loans and bonds.

As of December 31, 2020, Osaka’s Tennis Shop had total liabilities of $400,000. This includes $200,000 in current liabilities and $200,000 in long-term liabilities.

Equity

Osaka’s Tennis Shop’s equity is calculated as the difference between assets and liabilities. As of December 31, 2020, the shop’s equity was $800,000.

Equity can be further broken down into:

- Retained Earnings:This is the cumulative net income of the company that has not been distributed to shareholders as dividends.

- Share Capital:This is the total amount of money that has been invested in the company by shareholders.

Financial Ratios

Financial ratios can be used to analyze the financial health of a company. Some key financial ratios that can be calculated from the balance sheet include:

- Current Ratio:This ratio measures the company’s ability to meet its short-term obligations. It is calculated by dividing current assets by current liabilities.

- Debt-to-Equity Ratio:This ratio measures the company’s level of debt relative to its equity. It is calculated by dividing total liabilities by total equity.

As of December 31, 2020, Osaka’s Tennis Shop had a current ratio of 2.5 and a debt-to-equity ratio of 0.5. These ratios indicate that the shop is in a strong financial position.

Comparison to Industry Benchmarks

Comparing Osaka’s Tennis Shop’s balance sheet to industry benchmarks can provide insights into the shop’s financial performance relative to its peers. Industry benchmarks are typically calculated using data from a group of similar companies.

Osaka’s Tennis Shop’s current ratio and debt-to-equity ratio are both above the industry averages. This indicates that the shop is in a better financial position than its competitors.

Top FAQs

What is the purpose of a balance sheet?

A balance sheet provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

What are the key components of a balance sheet?

The key components of a balance sheet are assets, liabilities, and equity.

How can financial ratios be used to analyze a balance sheet?

Financial ratios can be used to analyze a balance sheet by providing insights into a company’s liquidity, solvency, profitability, and efficiency.